We want your feedback on the development contributions options being considered by the Council.

Share this

Consultation has now closed

Consultation on the Draft Development Contributions Policy 2021 has now closed. People were able to provide feedback from 12 March to 18 April 2021.

During this time we heard from 34 individuals and groups. You can read their feedback(external link) as part of the Hearings Panel agenda.

The Panel met on Friday 21 May to hear submitters and made a final decision which you can view in the meeting minutes on our website(external link).

We are required to review our development contributions policy at least every three years. The review allows us to consider policy options and to update information used to calculate development contribution charges such as:

- assumptions about typical use of our infrastructure from residential and commercial development

- growth forecasts and the increased demand on Council infrastructure expected from that growth

- growth capacity in existing infrastructure

- identifying new infrastructure required to service growth and the expected cost of this

- assumptions about future interest and inflation rates

This policy review is an opportunity for an in-depth assessment, as property development and construction return to more ‘normal’ levels following the post-earthquake rebuild period, and the new Christchurch District Plan is operative.

We are aiming to improve several policy areas including legislative compliance, fairness, efficiency and clarity.

Providing infrastructure for growth

Christchurch’s forecast population growth is close to one per cent per year. That means around 3,500 new residents each year requiring housing. With a current average home occupancy of 2.5 residents, we need to plan for around 1,500 new homes each year. Demand for new business premises will also increase with the growing population. This development places additional demand on our infrastructure and facilities.

We must invest in providing infrastructure now to ensure essential infrastructure like water, wastewater and roads will be available when growth occurs.

Providing additional infrastructure for a growing city comes at a cost. Over the past 15 years, the Council has invested on average about $50 million a year in infrastructure to service new growth development. Future investment will be at a similar level, to enable business and residential development to flourish.

Our policy is that those benefiting from the investment in infrastructure to service growth should largely fund the cost of that investment. We do that by requiring developers to pay a fair share of those costs through development contributions.

About development contributions

Development contributions are a charge to developers for a fair contribution towards the cost of providing new infrastructure like pipes, roads and parks. This reduces the funding required from existing residents through rates. We can only charge development contributions for development that increases demand on our infrastructure. This includes:

- residential or business subdivisions

- new houses

- new business premises

- development of existing buildings that creates additional apartments or business premises or that

increases capacity demand on our infrastructure

Drop-in sessions

Drop in sessions were held on:

- Tuesday 23 March 11.30 am to 1.30pm

- Wednesday 31 March 4.30pm to 6.30pm

These were shared sessions with colleagues from the Long Term Plan 2018-2031,(external link) the Draft Climate Change Strategy(external link), and the Representation Review Initial Proposa(external link)l.

The Development Contributions Policy 2021 is focused on achieving three key objectives:

- To ensure developers contribute fairly to funding infrastructure and facilities to service growth development.

- To provide certainty and transparency regarding infrastructure and facilities provided to service growth development, and how those assets will be funded.

- To ensure appropriate development contribution revenue is part of our overall revenue mix that funds the provision of infrastructure and facilities to service new development.

Strategic reasons

The provision of infrastructure is an essential part of our community leadership role in supporting public health and safety and sustainable development.

We invest in additional infrastructure in anticipation of growth and development contributions enable us to

do this.

Fairness and equity reasons

Requiring developers to fund a share of the cost of providing additional infrastructure for growth is fair and equitable. Development contributions complement other funding sources to provide a balanced approach.

Current residents have made considerable investment in the existing infrastructure through rates, some of which has capacity to cater for growth and can service new development at no cost to developers. It is appropriate that additional or new infrastructure required to service growth requirements should be funded primarily by those who benefit from it.

Do you think it is fair that developers pay a share of the cost of providing infrastructure to service growth? Or should all the cost be met by ratepayers?

Are there alternative ways to fund growth infrastructure that the Council should use instead?

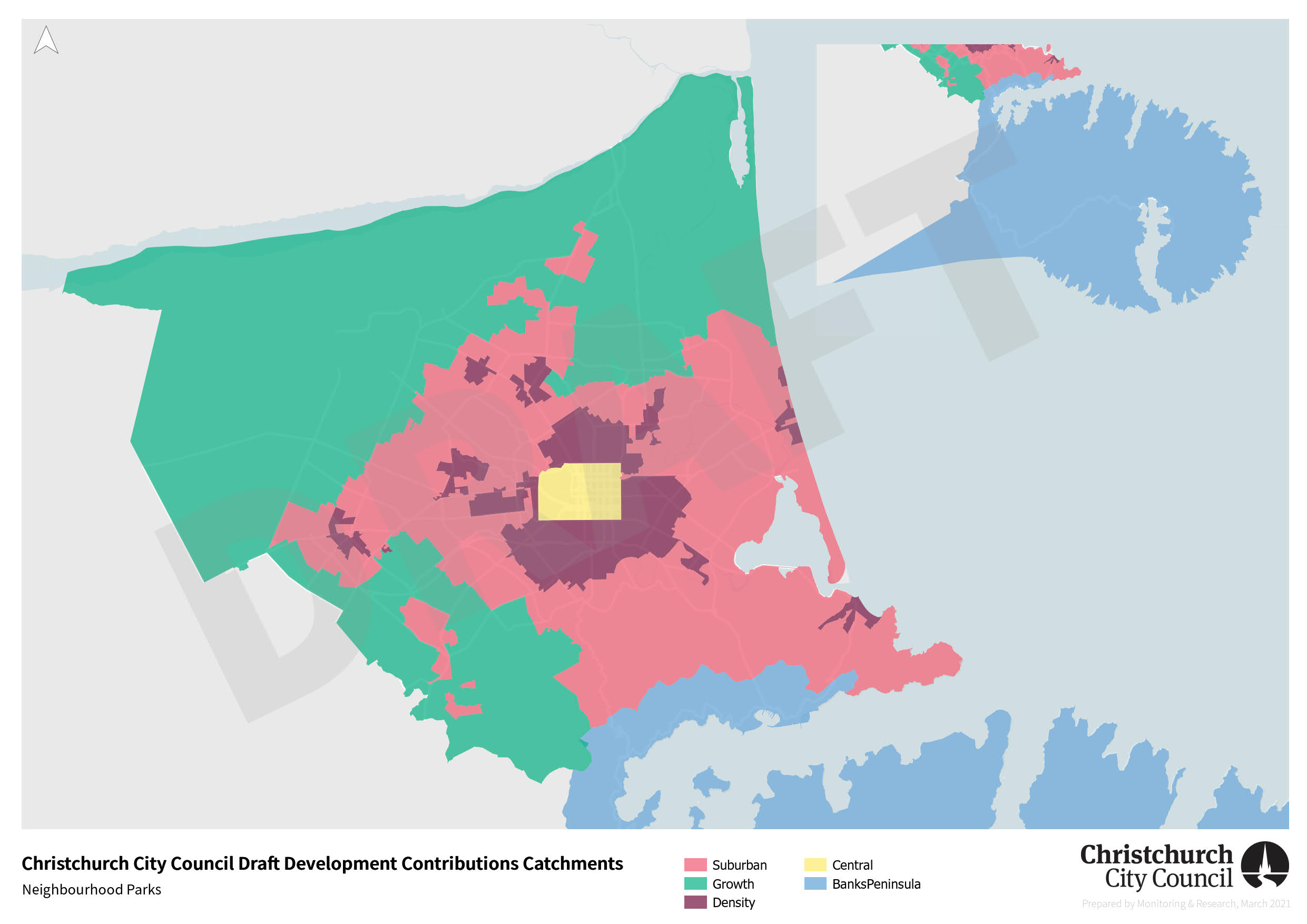

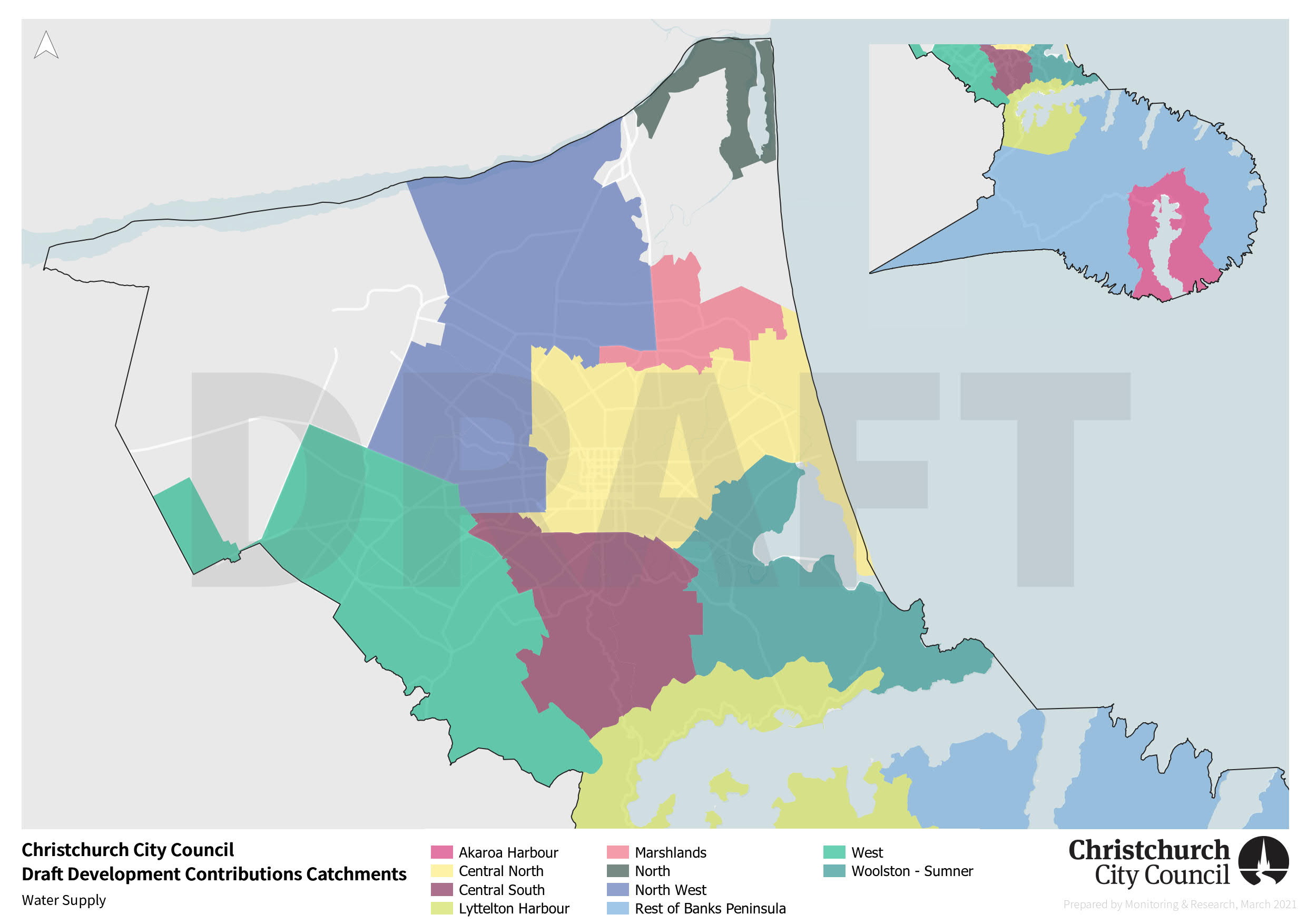

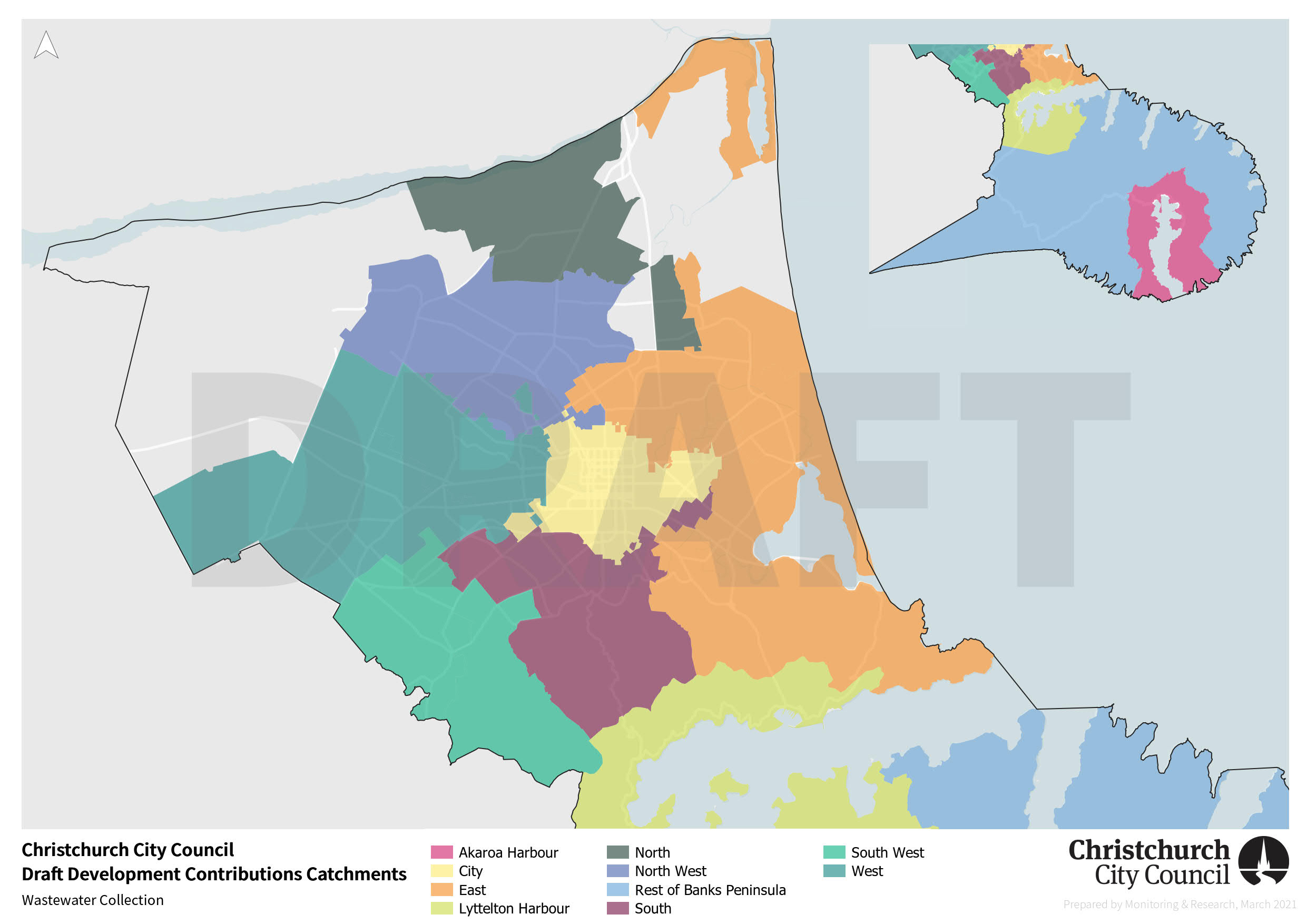

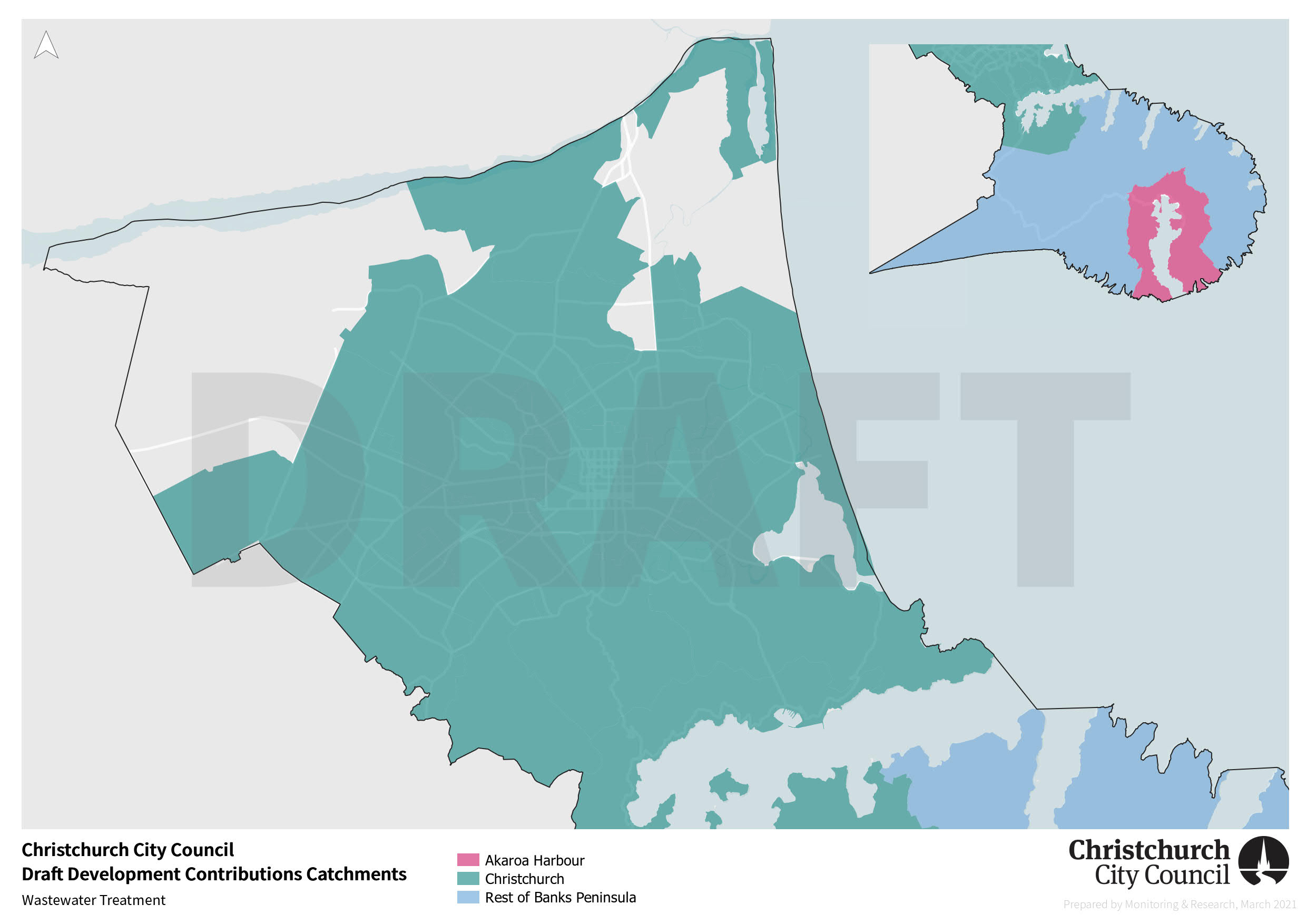

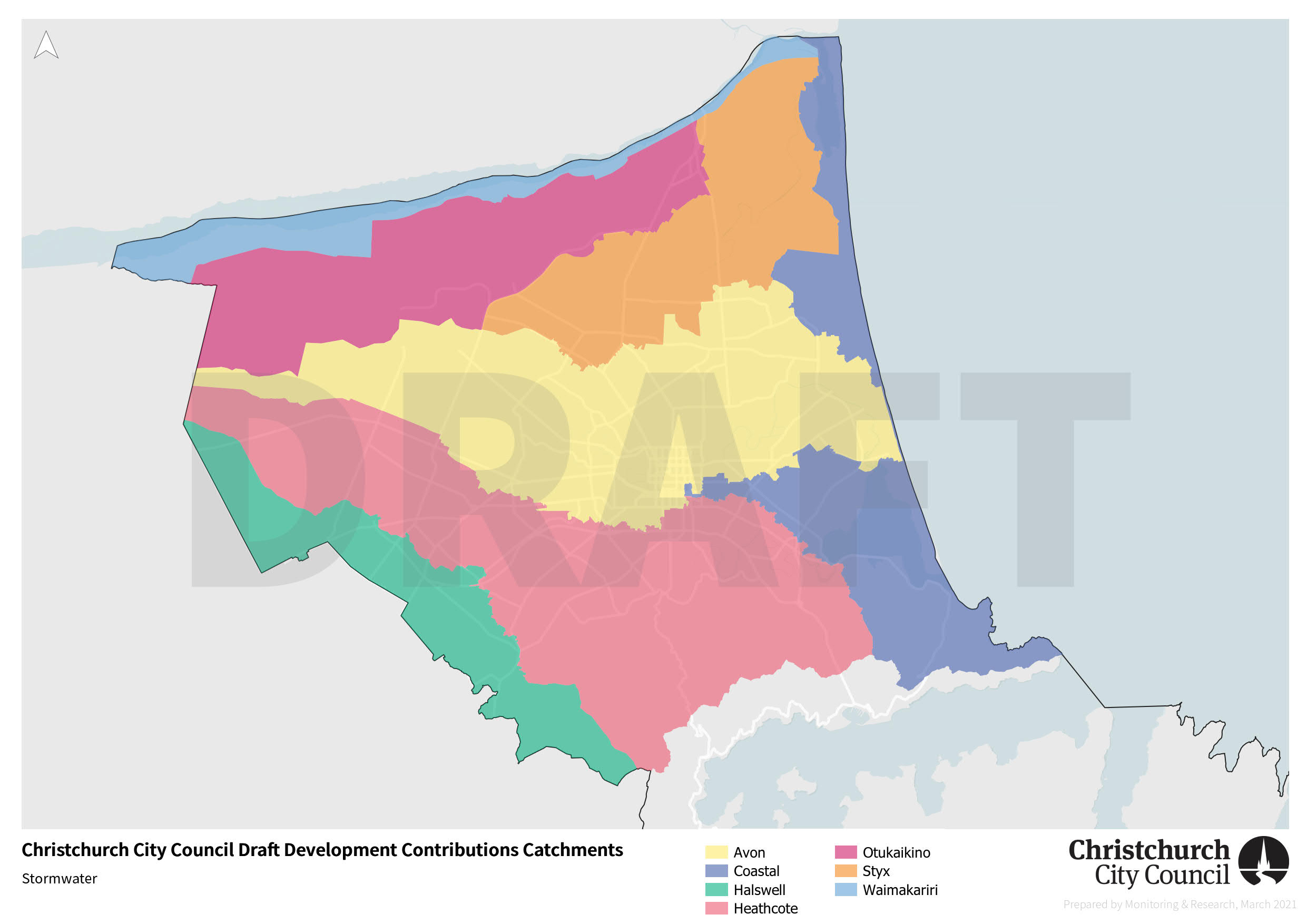

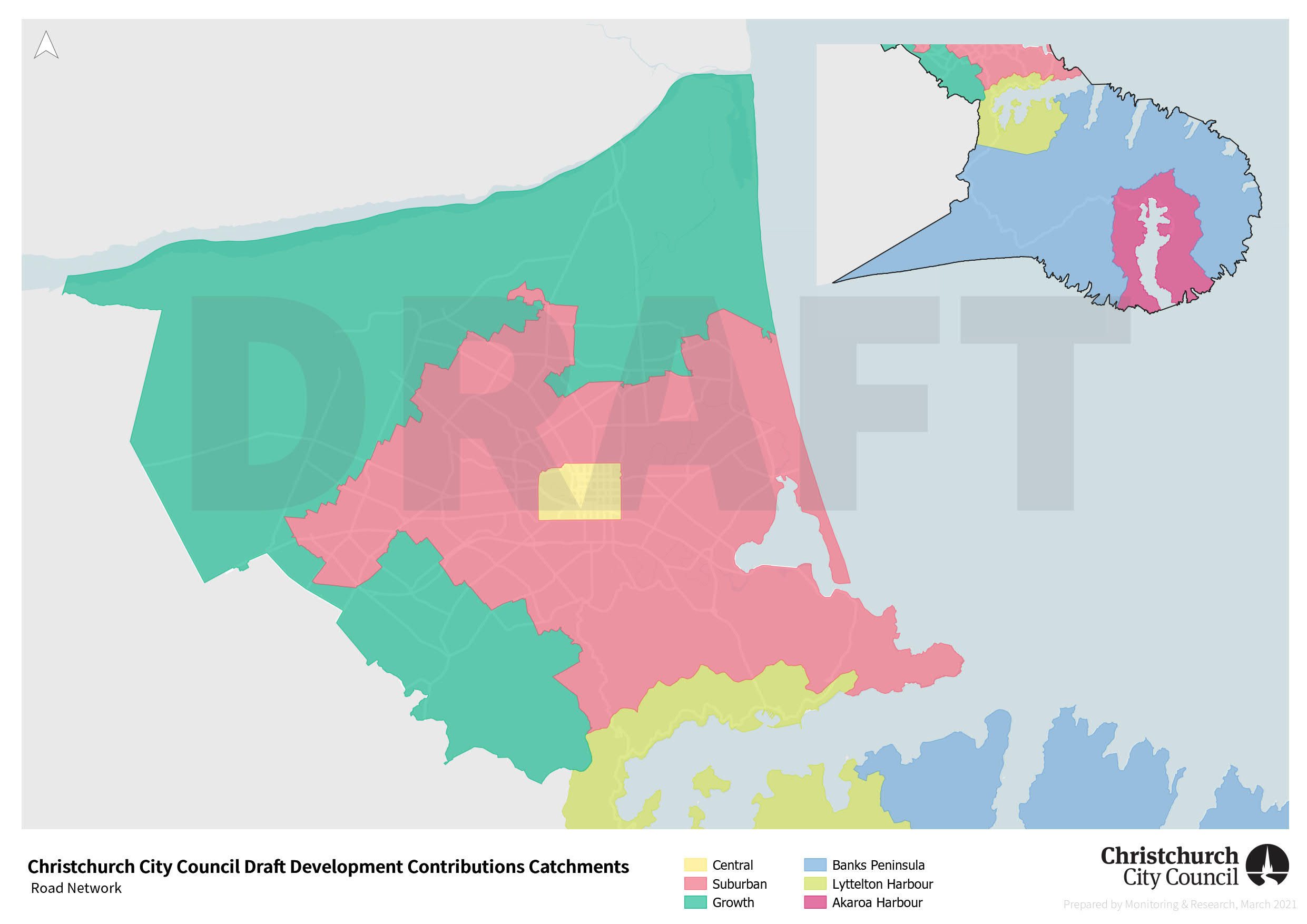

Use of catchments to calculate development contributions

The Local Government Act (LGA) details how development contributions can be calculated. It states that development contributions should not be calculated across the whole district, where possible. By dividing the district into areas of common interest we call catchments, the cost of infrastructure for growth can be calculated and then paid for by development in that catchment. The cost of providing growth infrastructure for each area is then identified and allocated to development in that area. This reduces cross-subsidising of those costs and can encourage development in the most cost-effective locations for infrastructure provision.

The Council currently calculates development contributions at a catchment level for road transport, neighbourhood parks and stormwater and flood protection. We propose the use of catchments for the following infrastructure types.

Water supply – We propose a separate catchment for each water supply scheme and multiple catchments for the Christchurch metropolitan scheme. This allows for a range of charges, with smaller communities and greenfield development areas paying more, and Christchurch infill development areas paying comparatively less.

Wastewater collection - We propose a separate catchment for each scheme and multiple catchments for the Christchurch metropolitan scheme. This allows for a range of charges, with smaller communities and greenfield development areas paying more, and Christchurch infill development areas paying comparatively less.

Wastewater treatment and disposal - The only logical approach is a separate catchment for each scheme, including Christchurch. This allows for a range of charges with smaller communities like Akaroa paying more and Christchurch infill development areas paying comparatively less.

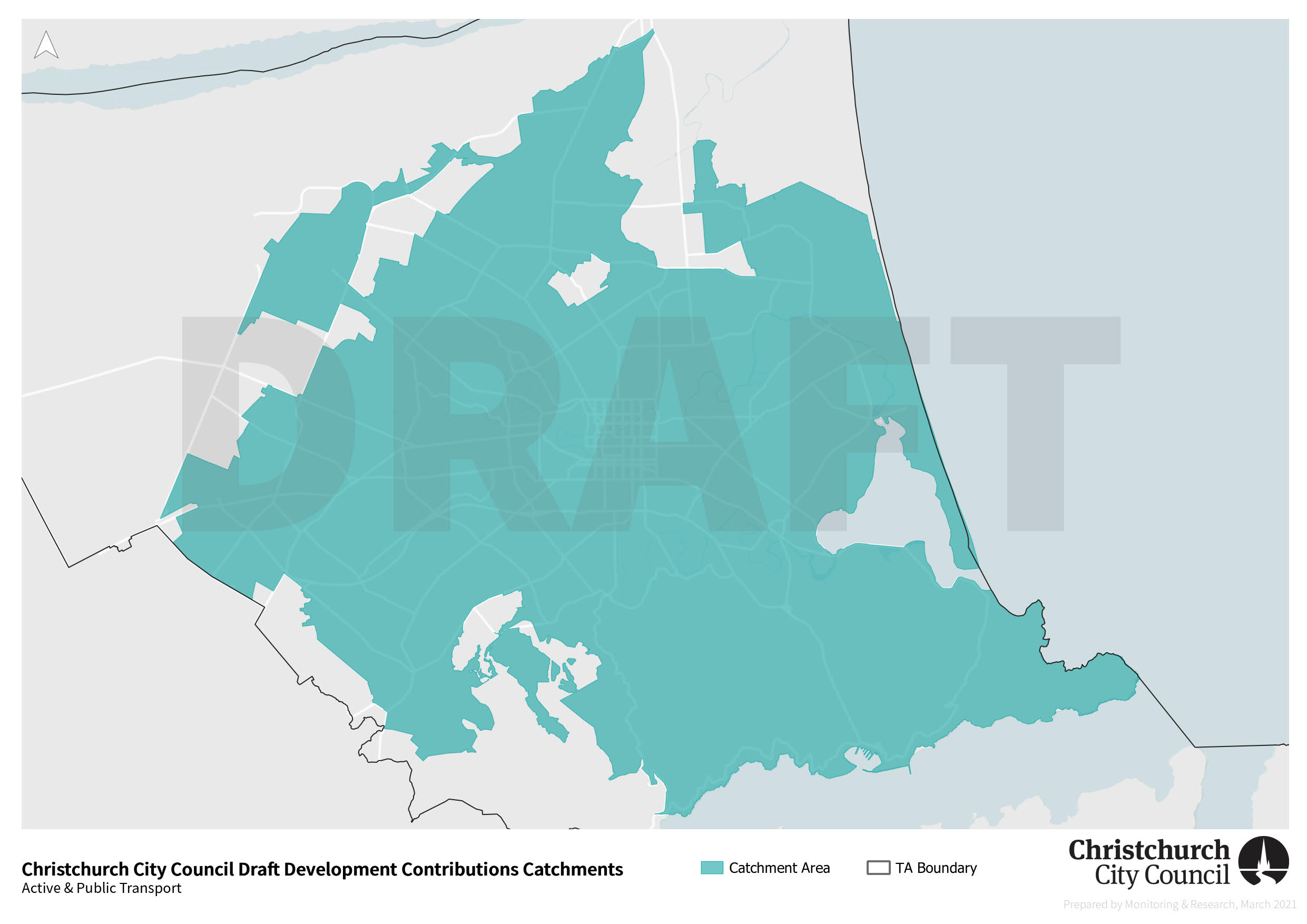

Public and active transport – We propose a single catchment covering urban areas only, rather than the whole district (as currently). This allows for the development contribution charge for urban areas to increase slightly and for areas that don’t receive this infrastructure, not to be charged.

Advantages of calculating by catchments

Aligns benefit with cost - The use of catchments ensures the development contributions charged are aligned to the cost of providing infrastructure to service growth in each part of the district. This supports the ‘beneficiary should pay principle’ that guides many of Council’s funding decisions. It may also encourage development in the areas where it is expensive to provide new infrastructure to provide growth capacity.

Disadvantages of calculating by catchments

Higher charges for some catchments - We have significantly invested in upgrading water and wastewater infrastructure in Akaroa Harbour communities to bring services up to an appropriate standard. This means development contributions for Akaroa calculated at a catchment level, are much higher than previously, going from $21,500 per household unit equivalent to $70,248.

Development contributions of this magnitude may deter some types of development, particularly lower value residential developments where the development contribution charge would represent a significant

proportion of the overall cost.

The Council has some options to reduce the development contribution charge for Akaroa if it considers this is necessary to promote community wellbeing. Analysis has been undertaken on the possibility of:

- capping the development contributions charge for Akaroa. This would require rates to fund the

shortfall over time - retaining a district-wide catchment for wastewater treatment and disposal which would spread the

cost overall development in Christchurch district.

The proposal put forward in the draft policy is to leave the proposed Akaroa development contributions charge at $70,248 and seek community feedback whether the charge should be reduced or not.

Do you think we should use of catchments to calculate the development contributions charges, or should we take a district-wide approach?

A district-wide approach would mean the small number of developments outside the city are subsidised by developments in the city – do you think this is fair?

If we use catchments to calculate development contributions do you think a maximum charge or cap should apply to keep development contribution charges in smaller communities lower?

If we cap development contributions in rural areas what should the charge be?

In March 2019 the definition of community infrastructure in the Local Government Act 2002 was changed back to the definition that had been used until 2014. This means we can now use development contributions to recover the costs of providing future growth capacity for facilities such as swimming pools, sports centres, libraries and cemeteries.

From 2014 these facilities have been funded entirely from rates. We are proposing requiring a development contribution for these facilities, which would result in a minor reduction in rates required.

Many of the recently built, under construction or planned community facilities replace facilities lost in the earthquakes. The cost of replacing previous facilities and insurance funding is excluded from development contribution calculations to avoid double funding community facilities.

We are proposing both business and residential developments are assessed for development contributions for community infrastructure, as was the case prior to 2014. We propose to include business developments to:

- improve equity between residential and non-residential activities;

- recognise that some of the workforce associated with non-residential activities are not residents of

Christchurch; and can be users of leisure facilities and libraries and can change the pattern of demand.

We are proposing that new business developments are assessed as being one household equivalent for each development. This is because while it is likely business development will result in some additional demand on community infrastructure, it isn’t possible to accurately assess this demand based on the scale of development or the type of business.

Do you think we should charge development contributions for the cost of future-proofing community

facilities?

Do you think business developments should be required to pay development contributions for

community facilities such as swimming pools and libraries?

Changes to the Local Government Act also restored our ability to charge non-residential developments for the various parks activities grouped under reserves.

We are proposing that business developments be assessed as being one household unit equivalent for each development be assessed for parks activities as being one, rather than being assessed as a proportion of residential demand. This is because while it is likely business development will place some demand on reserves it isn’t possible to accurately assess this demand based on the scale of development or the type of business.

Do you think business developments should be required to pay development contributions for reserve infrastructure?D

We are looking at how we provide neighbourhood parks in infill development areas to meet the requirements of a growing local community. In most cases, purchasing land for parks is problematic and expensive. Investing in existing parks is a cost-effective way to meet growing community needs.

We are proposing to introduce a ‘medium density infill’ catchment for the neighbourhood parks activity in our Long Term Plan, which mirrors the medium density and transitional residential zones in the District Plan. This will enable investment in neighbourhood parks in areas of the city experiencing infill growth and would be funded from developments in those areas.

Do you think development contributions are an appropriate way to fund improved neighbourhood park facilities in residential areas experiencing growth development?

We are proposing a change to the way residential units with a gross floor area of 100m2 or less are assessed for development contributions.

The current policy provides for a small residential unit adjustment to be applied to residential units with a gross floor area of less than 100m2. The adjustment is applied on a sliding scale in proportion to the unit’s gross floor area. Currently, the maximum adjustment is to 60m2 or 0.6 household unit equivalents.

We are proposing to extend the gross floor area maximum adjustment to 35m2, or 0.35 household unit equivalents. This will bring the adjustment into line with the smallest residential unit permitted under the District Plan, which is 35m2.

Do you agree that small residential units should receive a reduction in the development contribution charge based on an assumed lower than average demand on infrastructure?

Are there any alternative approaches you think we should consider with respect to smaller dwellings – e.g. base any adjustment on number of bedrooms or number of rooms?

Change in catchment for active travel and public transport

We are proposing that areas outside the city are not charged a development contribution for active travel. The specific catchment boundaries align with the areas of the district that receive each service.

Special assessment criteria

Non-residential developments that put demand on infrastructure that is significantly higher than the average are assessed for development contributions using a special assessment. We are proposing that medical centres and courier depots are removed from the list of business types that require a special assessment. These types of business place a similar to average demand on infrastructure and the cost to the Council of undertaking a special assessment is not warranted.

Reduction in development contribution charges for reserves activities

The proposed development contribution charges for parks and reserves are significantly less than in the

current policy. There are two main reasons for this;

- infrastructure becoming fully funded

- changes to the forward capital expenditure programme in our Long Term Plan.

As part of the policy review the schedule of assets is also reviewed and any assets that are, or soon will be fully

funded are removed.

Development contributions rebate scheme for development on papakāinga land

We are looking at introducing a development contribution rebate scheme for development on land in papakāinga zones of the District Plan. This will be progressed in parallel with the consultation and then adoption of the Development Contributions Policy.

A rebate scheme will form part of a wider package of Council policies designed to facilitate development of papakāinga land to promote the wellbeing of relevant iwi and hapu.

The following proposed charges are for 1 Household Unit Equivalent (HUE) in various parts of the district. Depending on catchment boundaries the charges may not correlate with some perceptions of location within the district. All charges include GST.

Central City

| Activity | Current charge | Proposed charge |

| Regional parks | $2,695.60 | $223.20 |

| Garden & heritage parks | $161.00 | $192.21 |

| Sports parks | $2,530.00 | $471.51 |

| Neighbourhood parks | $1,775.60 | $139.12 |

| Water supply | $2,395.45 | $806.82 |

| Wastewater collection | $6,349.15 | $601.20 |

| Wastewater treatment & disposal | $2,904.90 | $1,064.70 |

| Stormwater & flood protection | $798.10 | $855.09 |

| Road network | $907.35 | $1,591.5 |

| Active travel | $425.50 | $2,759.70 |

| Public transport | $717.60 | $960.15 |

| Community infrastructure | Nil | $979.58 |

| Total | $21,660.25 | $10,644.79 |

Linwood medium density

| Activity | Current charge | Proposed charge |

| Regional parks | $2,695.60 | $223.20 |

| Garden & heritage parks | $161.00 | $192.21 |

| Sports parks | $2,530.00 | $471.51 |

| Neighbourhood parks | $2,837.05 | $67.62 |

| Water supply | $2,395.45 | $806.82 |

| Wastewater collection | $6,349.15 | $597.41 |

| Wastewater treatment & disposal | $2,904.90 | $1,064.70 |

| Stormwater & flood protection | $798.10 | $855.09 |

| Road network | $932.65 | $1,591.51 |

| Active travel | $425.50 | $2,759.70 |

| Public transport | $717.60 | $960.15 |

| Community infrastructure | Nil | $979.58 |

| Total | $22,747.00 | $10,569.50 |

Papanui Suburban

| Activity | Current charge | Proposed charge |

| Regional parks | $2,695.60 | $223.20 |

| Garden & heritage parks | $161.00 | $192.21 |

| Sports parks | $2,530.00 | $471.51 |

| Neighbourhood parks | $1,775.60 | $622.09 |

| Water supply | $2,395.45 | $1,392.68 |

| Wastewater collection | $6,349.15 | $2,487.14 |

| Wastewater treatment & disposal | $2,904.90 | $1,064.70 |

| Stormwater & flood protection | $798.10 | $855.09 |

| Road network | $975.20 | $1,578.44 |

| Active travel | $425.50 | $2,759.70 |

| Public transport | $717.60 | $960.15 |

| Community infrastructure | Nil | $979.58 |

| Total | $21,728.10 | $13,586.49 |

Halswell Greenfield

| Activity | Current charge | Proposed charge |

| Regional parks | $2,695.60 | $223.20 |

| Garden & heritage park | $161.00 | $192.21 |

| Sports parks | $2,530.00 | $471.51 |

| Neighbourhood parks | $9,535.80 | $545.85 |

| Water supply | $2,395.45 | $1,392.68 |

| Wastewater collection | $6,349.15 | $8,263.52 |

| Wastewater treatment & disposal | $2,904.90 | $1,064.70 |

| Stormwater & flood protection | $5,436.05 | $15,452.02 |

| Road network | $3,315.45 | $4,895.08 |

| Active travel | $425.50 | $2,759.70 |

| Public transport | $717.60 | $960.15 |

| Community infrastructure | Nil | $979.58 |

| Total | $36,466.50 | $37,200.20 |

Belfast Greenfield

| Activity | Current charge | Proposed charge |

| Regional parks | $2,695.60 | $223.20 |

| Garden & heritage park | $161.00 | $192.21 |

| Sports parks | $2,530.00 | $471.51 |

| Neighbourhood parks | $9,535.80 | $545.85 |

| Water supply | $2,395.45 | $2,487.14 |

| Wastewater collection | $6,349.15 | $4,910.24 |

| Wastewater treatment & disposal | $2,904.90 | $1,064.70 |

| Stormwater & flood protection | $724.50 | $11,129.38 |

| Road network | $3,315.45 | $4,895.08 |

| Active travel | $425.50 | $2,759.70 |

| Public transport | $717.60 | $960.15 |

| Community infrastructure | Nil | $979.58 |

| Total | $31,754.95 | $30,618.74 |

Lyttelton

| Activity | Current charge | Proposed charge |

| Regional parks | $2,695.60 | $223.20 |

| Garden & heritage park | $161.00 | $192.21 |

| Sports parks | $2,530.00 | $471.51 |

| Neighbourhood parks | $1,775.60 | $159.09 |

| Water supply | $2,395.45 | $12,876.42 |

| Wastewater collection | $6,349.15 | $7,215.30 |

| Wastewater treatment & disposal | $2,904.90 | $1,064.70 |

| Stormwater & flood protection | $724.50 | $225.95 |

| Road network | $907.35 | $1,566.34 |

| Active travel | $425.50 | $2,759.70 |

| Public transport | $717.60 | $960.15 |

| Community infrastructure | Nil | $979.58 |

| Total | $21,586.65 | $28,694.15 |

Akaroa Harbour

| Activity | Current charge | Proposed charge |

| Regional parks | $2,695.60 | $223.20 |

| Garden & heritage park | $161.00 | $192.21 |

| Sports parks | $2,530.00 | $471.51 |

| Neighbourhood parks | $1,775.60 | $159.09 |

| Water supply | $2,395.45 | $12,296.40 |

| Wastewater collection | $6,349.15 | $6,615.89 |

| Wastewater treatment & disposal | $2,904.90 | $47,383.69 |

| Stormwater & flood protection | $724.50 | $360.14 |

| Road network | $907.35 | $1,566.34 |

| Active travel | $425.50 | Nil |

| Public transport | $717.60 | Nil |

| Community infrastructure | Nil | $979.58 |

| Total | $21,586.65 | $70,248.05 |

Downloadable Maps

Neighbourhood Parks [PDF, 8.1 MB]

Water Supply [PDF, 11 MB]

Wastewater collection [PDF, 11 MB]

Wastewater treatment [PDF, 11 MB]

Stormwater [PDF, 3.7 MB]

Road Network [PDF, 8.2 MB]

Active Travel and Public Transport [PDF, 3.1 MB]

Read the full review of the Development Contributions Policy [PDF, 4.5 MB]

Read the key proposed policy amendments [PDF, 331 KB]